A person may reach that certain point in their lives when they want to switch healthcare plans. That usually happens when you, yourself or someone you know reaches the momentous age of 65. You may want to switch plans, or maybe get a new one using Medicare. There are some things that may help in steering you to the direction of knowing or educating you when to apply for a Medicare plan, start of the coverage, and how to sign up.

There is a primary 7-month period of enrollment during the time you are first looking to apply for a Medicare plan. You may sign up for Part A and / or Part B plans.

This period would consist of the following:

- Prior to you turning 65 – 3 months

- Once you do turn 65 – 1 month

- After the month you turn 65 – 3 months

In the event that you are not automatically enrolled into coverage for Part A, and once you qualify you can actually sign up free of charge, all of which may be done during or even after the initial enrollment period. The start date of the coverage will depend on the date that you sign up.

You may only enroll throughout an enrollment period if you need to purchase Part A and / or Part B. Here is an important note to remember: you might have to pay for a late enrollment penalty charge if you decide to purchase Part B later than the time you were first eligible to enroll.

Part A and / or Part B General Enrollment

Here are some important dates to take note of when signing up for Part A and / or Part B. It is advised to sign up on the dates that run between January 01 until March 31 of each year.

You may sign up during these time frames if you fall under the following circumstances:

- You are not eligible for a SEP or Special Enrollment Period.

- You did not sign up when you were first eligible.

- Note | You may have to pay a higher premium for both plans if you enroll late. Coverage will begin July 1.

For Special Circumstances:

There is another possibility to sign up for Medicare as soon as the initial enrollment phase lapses. This is what is commonly called as SEP or Special Enrollment Period.

If you want to sign up for Part A and / or Part B and you are covered under an employer’s group health plan, you must meet the following prerequisites first:

- You are covered by a group health plan through an employer.

- You or your spouse remains employed.

- An 8 month Special Enrollment Period will take over the month after your payment and the employee group health coverage ends.

You will NOT be charged for any penalty if you are signing up under SEP.

When will the coverage start?

Your coverage will begin on the very first day of the month you will be turning 65, that is if you signed up for the Medicare coverage AND, at the same time, you signed up during the first three months on YOUR initial enrollment period.

If your birthdate falls on the first of the month, then your coverage will start on the first of the previous month.

How do I apply?

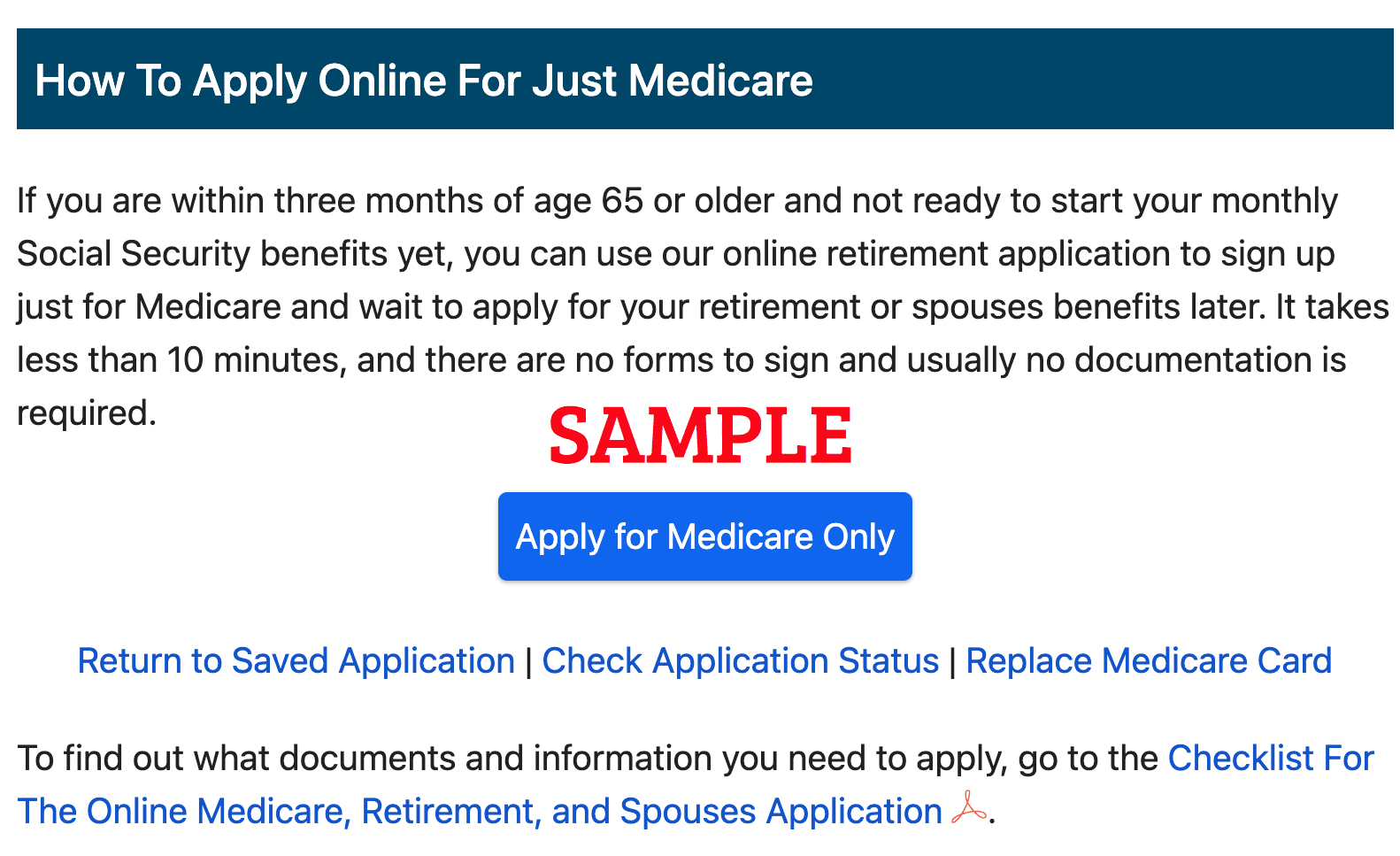

Just click the button below or select this link if you wish to apply for Medicare ONLINE.

To learn what documents and information you need to apply, go to the Checklist For The Online Medicare, Retirement, and Spouses Application.

You may still apply for Medicare even if you are still not ready to retire. This process may be done online and can take as little as 10 minutes. You are already done once you have submitted your application. There will be no physical forms that you have to sign and normally no documentation process. The SSA office will be the one to process and they will have to contact you should they require any more information. Otherwise, you will automatically obtain your Medicaid card in your mailing address. If an issue arises, you will be receiving documentation by mail.

You may also contact Medicare by phone at 1-800-772-1213 to enroll or apply for Medicare.

OR

Visit your local Social Security Office in person.

What Happens After I Apply?

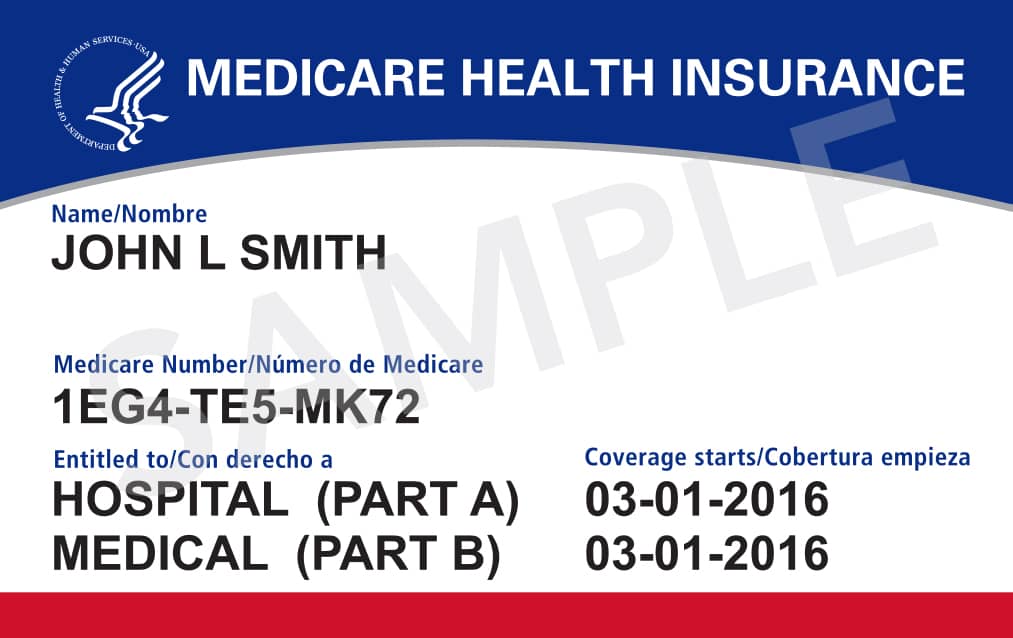

After you complete the application and are enrolled they will send you a Welcome to Medicare packet in the mail along with your Medicare card. You will also receive the Medicare & You handbook, with important information about your Medicare coverage choices. The Centers for Medicare & Medicaid Services CMS) manages Medicare.

Medicare Card Information

Your Medicare card has a Medicare number that’s unique to you in order to help protect your identity . If you have not yet receive your red, white, and blue Medicare card, there may be something that needs to be corrected, like your mailing address. You may update your mailing address by signing in to or creating your personal my Social Security account. Learn more about your Medicare card.

What you need to know about your Medicare Card:

- Instead of your Social Security Number, your card has a Medicare Number that’s unique to you. This helps to protect your identity.

- Your card is made of paper, which makes it easier for many providers to use and copy.

- Even if you’re in a Medicare Advantage Plan (like an HMO or PPO), your Medicare Advantage Plan ID card is your main card for Medicare so you should still keep and use it whenever you need care. And, if you have a Medicare drug plan, be sure to keep that card as well. You also may be asked to show your Medicare card when if you use one of these other cards so be sure to always keep it with you.

- Watch out for scams.* Medicare will never call you uninvited and ask you to give us personal or private information. Therefore, only give your Medicare Number to doctors, pharmacists, other health care providers, your insurers, or people you trust to work with Medicare on your behalf.

- If you happen to forget your card, you, your doctor or other health care provider might be able to look up your Medicare Number online.

*Scam artists may try to get personal information, like your Medicare Number. If someone asks you for your information, for money, or threatens to cancel your health benefits if you don’t share your personal information, immediately hang up and call 1-800-MEDICARE (1-800-633-4227). Find out more about the limited situations in which Medicare can call you.